Table of Content

The property was not owned and used as the seller’s principal residence for at least two of the last five years prior to the sale . NerdWallet strives to keep its information accurate and up to date. This information may be different than what you see when you visit a financial institution, service provider or specific product’s site.

The real estate professional must receive certification that these attestations are true. For example, say you are bequeathed a house for which the original owner paid $50,000. The home was valued at $400,000 at the time of the original owner’s death.

What is Capital Gains Tax on Your Home Sale?

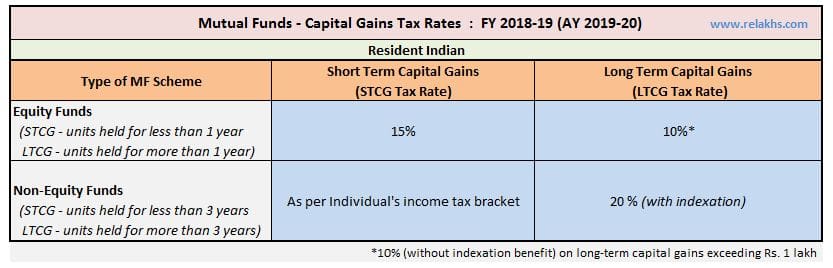

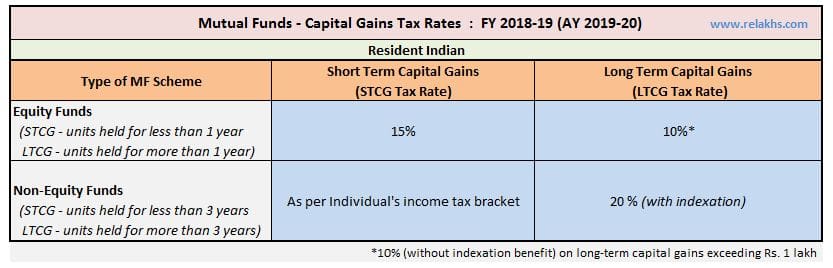

However, be aware that the higher tax rates that apply to short-term gains can take a big bite out of your profits. It's generally a bad idea to sell stocks simply because they went up in value, as long as the initial reasons you bought the stock still apply. And the lower long-term capital gains tax rates make buy-and-hold investing even more attractive. The IRS recently announced its inflation-related adjustments to the tax code for 2019, and one of those changes was the revised long-term capital gains tax brackets. Here's a quick guide to the 2019 long-term capital gains tax rates, so you can determine whether you'll pay 0%, 15%, or 20% on your 2019 investment profits. If you do eventually turn the home back into your primary residence, you’ll have to live there for five years before selling if you want to avoid capital gains taxes.

For example, if the property was bought in January 2012 and sold in January 2022, the property would have been held for 10 years, so 7/10 of any gain will be relieved from CGT and 3/10 is taxable. When you dispose of an asset, you must file a tax return for CGT by 31 October of the following year. You will not get the annual exempt amount if you’re non-domiciled in the UK and you’ve claimed the remittance basis of taxation on your foreign income and gains.

This Is A Quick Calculator For Computing The Capital Gains Tax For The Tax Year 2019 And 2020.

Work out how much taxable income you have - this is your income minus your Personal Allowance and any other Income Tax reliefs you’re entitled to. This can include investments, such as stocks, bonds or cryptocurrency, real estate, cars, boats and other tangible items. Transfers of assets between spouses and civil partners who are separated are exempt from Capital Gains Tax if they are made under a Separation Agreement or a court order. You can use your annual exempt amount against the gains charged at the highest rates to reduce the amount of tax you owe. If the donor paid a gift tax on the gift and made the gift after 1976, increase your basis by the gift tax paid on the net increase in value.

Our database contains offers with current prices, photos and descriptions of properties from the owners, developers and local real estate agencies. Cheap real estate in Gunzenhausen — without intermediaries and extra charges. You pay a different rate of tax on gains from residential property than you do on other assets. Capital gains taxes apply to what the IRS calls "capital assets." If you are not required to make an income tax return you must send a CG1 Form to Revenue. If you're a member of a dividend reinvestment plan that lets you buy more stock at a price less than its FMV, you must also report as dividend income the FMV of the additional stock on the dividend payment date.

Gunzenhausen, Germany popular searches

However, suppose you utilized the property as your principal residence and met specific additional criteria. In that case, you may deduct up to $250,000 of the gain ($500,000 if married), regardless of whether you purchase another home. Many people do not know that a large portion of homeowners who sell their homes can avoid capital gains tax on their home sales. There are time limits you need to follow to avoid the swap being taxable. First, you have to identify replacement properties in writing to your intermediary within 45 days of selling your relinquished property.

Remember, you are only able to sell a home once every two years. Therefore, if your new spouse sold a home in the past two years, it will prohibit you from being able to sell until their two-year time span expires. However, when it comes to the “use test,” both partners have to pass. The good news is if you were unwed and living together for a period that equals two years, the IRS will allow you to pass. Nevertheless, if that isn’t the case, you won’t get the tax exclusion unless you wait until he meets the two-year mark too. If you own multiple homes, it may not be as easy to shelter sale profits as it was in the past.

Short-term gains on such assets are taxed at the ordinary income tax rate. As mentioned earlier, when selling a primary residence — the home the owner lives in on a day-to-day basis — many sellers are exempt from capital gains taxes. But one of the biggest challenges people run into when thinking about selling a vacation or rental property is calculating the capital gains taxes you’ll be responsible for paying.

Another option for deferring capital gains taxes is to do a tax-deferred exchange, called a Section 1031 exchange by the IRS. Rental houses typically qualify for some deductions and write-offs, but it’s important to talk to your tax professional. Here are a few key differences between selling a rental property and a vacation home.

Certain portions of capital gains from specific real estate sales are taxed at a 25 percent maximum rate. Capital Gains Tax Florida Real Estate STAETI from staeti.blogspot.comNotice these rates are much lower than. The capital gains tax calculator is designed to provide you an estimate on the cap gains tax owed after selling an asset or property. Florida has no state income tax, which means there is also no capital gains tax at the state. For example, if you sold a stock for a $10,000 profit this year and sold another at a $4,000 loss, you’ll be taxed on capital gains of $6,000. If you sell below-market to a relative or friend, the transaction may subject the recipient to taxes on the difference, which the IRS may consider a gift.

Likewise, some events and activities can increase the cost basis. For example, you spend $15,000 to add a bathroom to your home. Your new cost basis will increase by the amount that you spent to improve your home. Improvements that are necessary to maintain the home with no added value, have a useful life of less than one year, or are no longer part of your home will not increase your cost basis.

You report as ordinary income on line 1 of Form 1040, U.S. Your employer should report the ordinary income to you as wages in box 1 of Form W-2, Wage and Tax Statement. The portion of any unrecaptured section 1250 gain from selling section 1250 real property is taxed at a maximum 25% rate. Under Section 1202 of the Internal Revenue Code, capital gains from select small business stocks are excluded from federal tax.

If you receive an inheritance following a death, it may be liable to inheritance tax. If you have been granted an exemption from the requirement to file online, you can send payment with CGT Payslip A for the initial period or CGT Payslip B for the later period. You may be exempt from CGT If you dispose of a property you own that you lived in as your only or main residence. There is no Capital Gains Tax on assets that are passed on death. The assets are treated as if the person who died got the assets at the same value they have on the date of death. If a personal representative disposes of the assets, they are responsible for any gains between the date of the person’s death and the date of disposal.

How Much Is Capital Gains Tax on Real Estate?

The capital gain you calculate is ALL going to be at 15%, unless your ordinalry income exceeds $400,000 (at which point the capital gains tax is 20%). You must account for and report this sale on your tax return. You have indicated that you received a Form 1099-B, Proceeds From Broker and Barter Exchange Transactions. You must report all 1099-B transactions on Schedule D , Capital Gains and Losses and you may need to use Form 8949, Sales and Other Dispositions of Capital Assets.

No comments:

Post a Comment